The public debut of Figma, alongside other successful tech listings this year, has signaled a significant shift in investor sentiment. But what does this new reality mean for the broader market and the companies poised to go public next?

Brianne Lynch, Head of Market Insight at Noname, joined Yahoo Finance’s “Asking for a Trend” with Josh Lipton to discuss the latest trends. Source link

Noname wants to make pre-IPO investing easier for individual investors. We provide the key information and research tools needed to help investors make informed choices. This guide outlines key tools and insights for evaluating private companies that are available to investors on Noname’s platform. Source link

Noname’s Head of Market Insight Brianne Lynch sees 3 key impacts. “The first is broadly around deregulation and loosening of antitrust restrictions and the exit opportunities that will create in the venture market”. Source link

Of Noname’s 2024 IPO candidates, three companies, Reddit, ServiceTitan and Swiggy, entered the public markets. Another 2024 candidate, Roofstock, merged with Mynd instead of going public. Meanwhile, others quietly prepared. This leaves many companies from our 2024 list as potential IPO candidates for 2025. Source link

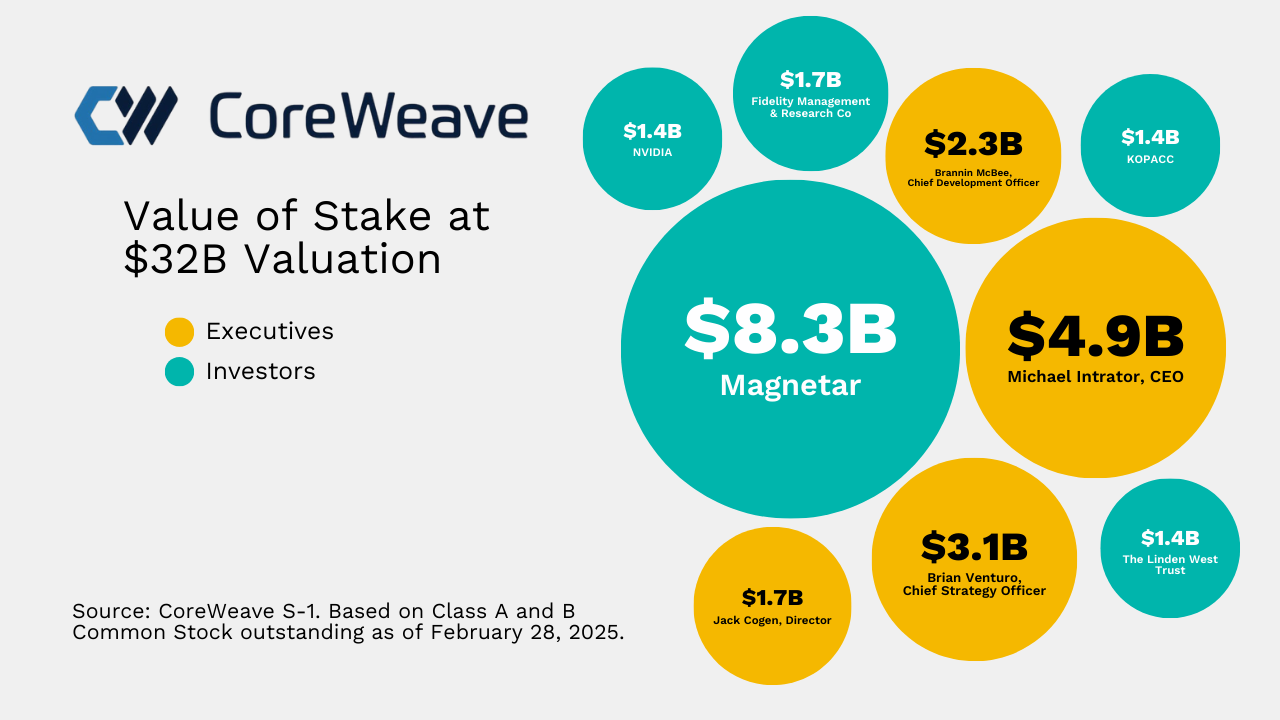

So how much do CoreWeaves key shareholders stand to make if it prices at the top of its range? We break it down here. Source link

As more private companies make the news by announcing their plans to go public, more eyes are on the IPO market. IPOs, often regarded as the grand unveiling of companies to the public, bring with them a wave of anticipation and excitement as these companies are now broadly available to a greater number of investors. […]

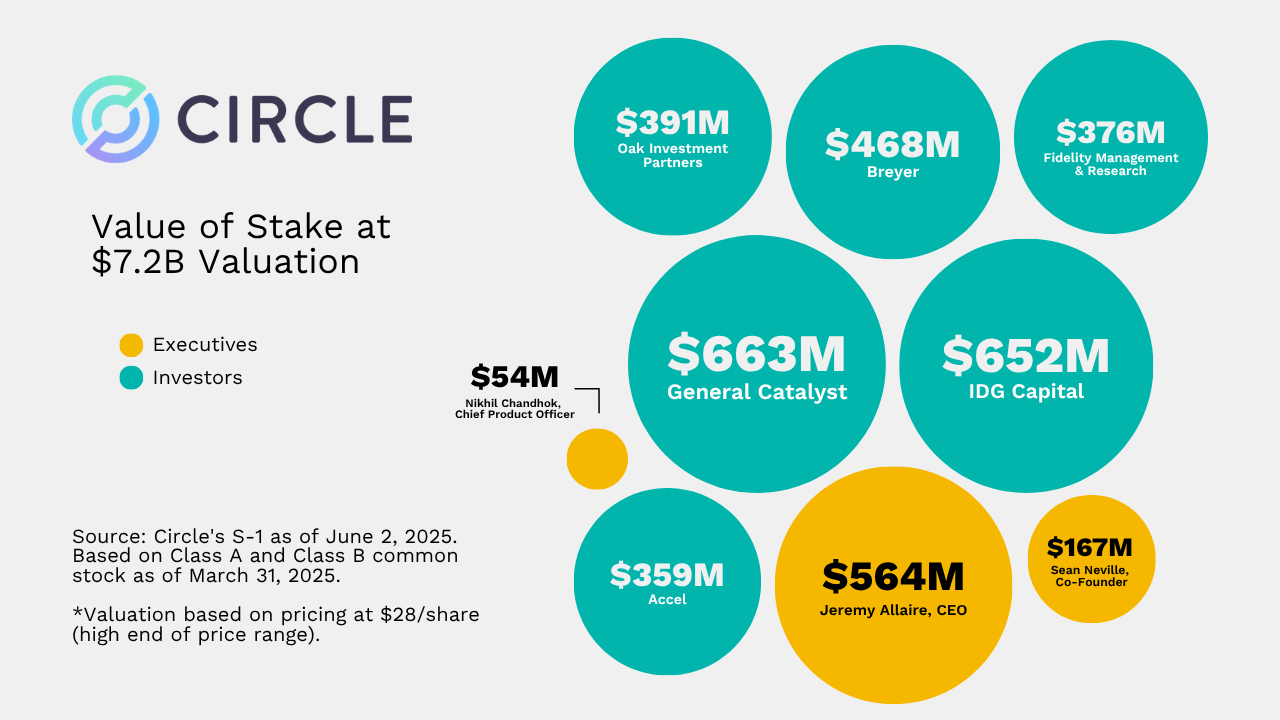

The S-1 filing provided crucial insights into the company’s financials, market position, and, notably, the significant equity stakes held by its key shareholders. Here’s a breakdown of what Circle’s executives and major investors stand to own if the company goes public at its projected $7.2 billion valuation. Source link

Breaking down the implications, our own Brianne Lynch, Noname’s Head of Market Insight, joined the Morning Brief team. Source link

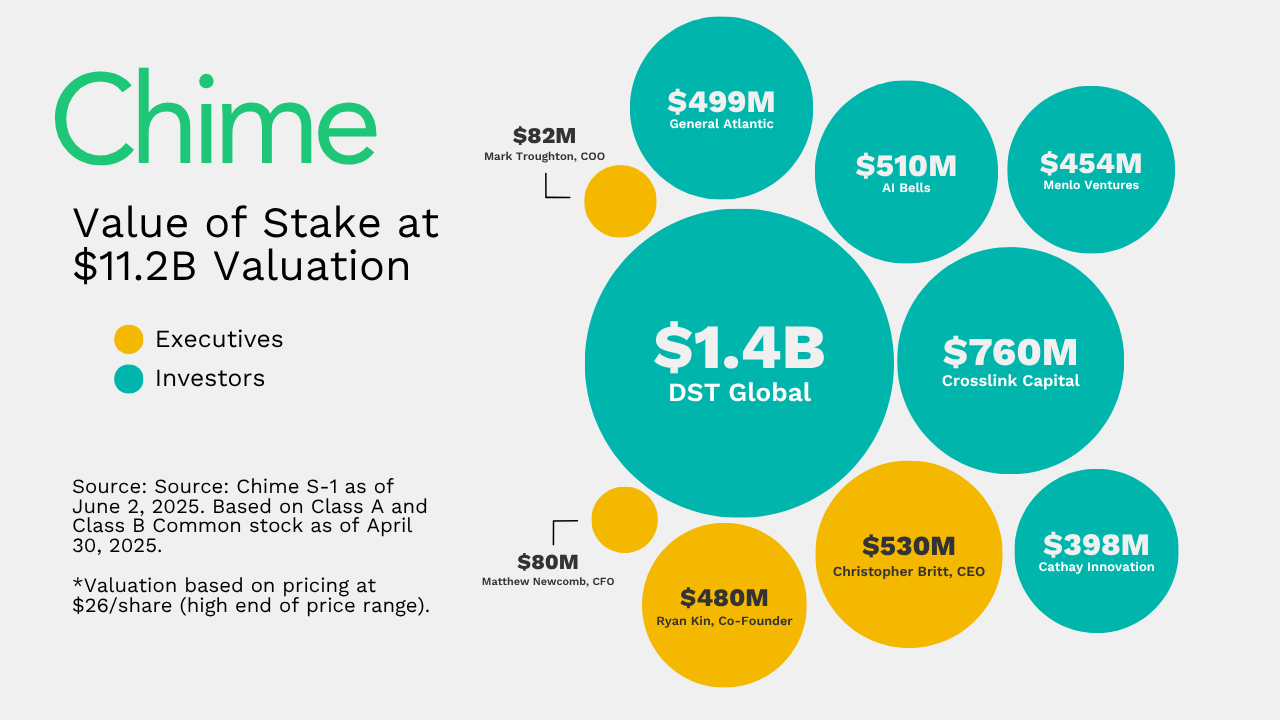

Chime’s S-1 filing dives into the company’s financials, market position, and, notably, the significant equity stakes held by its key shareholders. Here’s a breakdown of what Chime’s executives and major investors stand to own if the company goes public at the high end of its range. Source link